DeFi terms can be quite confusing. With the large wave of BSC (Binance Smart Chain) tokens launching with tokenomics, it’s important to understand the terminology used when interacting with or swapping tokens.

To put it simply, Slippage is a percentage setting used in swaps that allows for transactions to process when volume is volatile. Still confused?

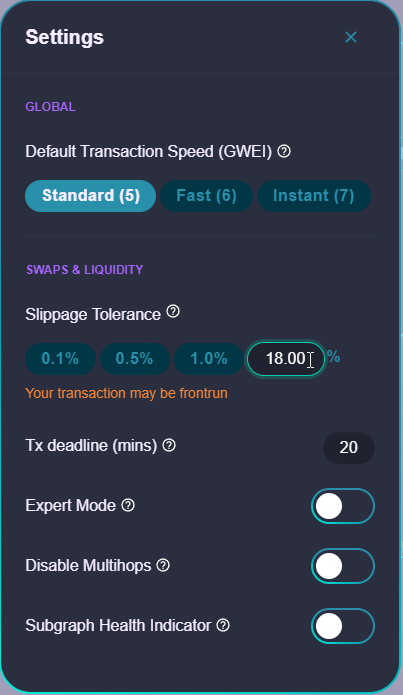

This is an example of a standard slippage setting window. Generally the slippage has a number preset.

Let’s take GlowV2 for an example. GlowV2 has a buy and sell tax of 15%. In order to to make sure your transaction goes through, you need to allow room for price fluctuation on top of the tokens tax. A general number to use is 3% higher than the token’s tax. Knowing this, we would add 3% to GlowV2’s tax of 15% to get a slippage setting of 18%

Token Tax + 3% = Slippage Setting

It’s important to remember that slippage IS NOT a tax. During moments of high volatility such as a new token launch or during hype of a new utility, sometimes you may need to increase your slippage to make sure that your trade goes through.

When someone is looking to execute a swap or trade of a token, the swap does it’s best to pull the most accurate price at the time. If a token is being rapidly swapped and volatility is high, the price could be changing rapidly. If slippage isn’t set high enough during these times, the swap doesn’t know what price you’re looking to purchase at so swap transactions will most likely fail. By increasing your slippage, you’re essentially telling the swap: “Even though the price is moving around like crazy, I want in!”

Always be sure to do your own research and find a tokens listed slippage setting. More advanced swaps, such as Safemoon Swap, will auto populate the tokens slippage but it’s a good practice to make sure you understand the settings and see that they’re set properly.